Nvidia’s done it, it has now joined the $1 trillion club, getting its door card to the gold-plated executive toilet along with such tech luminaries as Amazon, Microsoft, and Alphabet (essentially Google). Oh yeah, and purveyor of overpriced technology, Apple.

The milestone was reached today (via The Guardian) as its share price continued to surge after the huge Q2 revenue estimates made during its recent Q1 earnings call. It completely distracted from the fact it was 13% down year-on-year by noting that it expected revenue to hit $11Bn in Q2—64% up year-on-year.

But, while the share price made a huge jump on the back of that announcement, it’s only today, after a 6% rise, that it’s breached the $1 trillion mark in terms of market capitalisation. In fact, it’s still rising as I write this and the market cap is actually standing at $1.02 trillion right now.

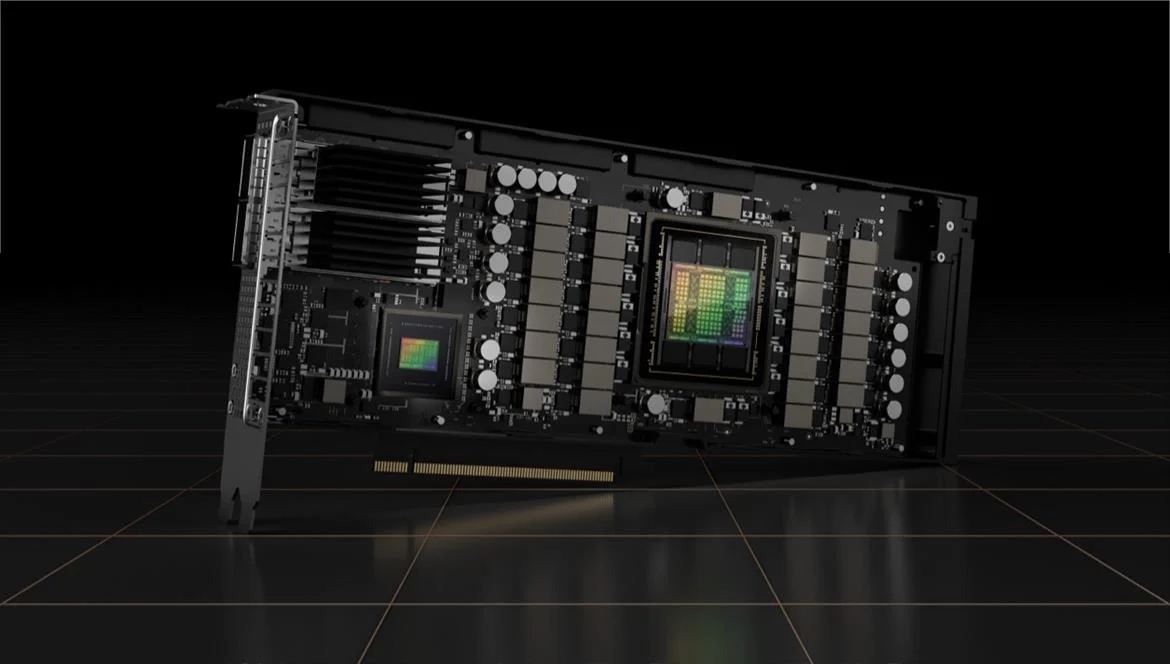

That’s all based on the fact it’s powering the current darling of the tech industry, namely generative AI. Nvidia’s datacentre GPUs are the parallel number crunching monsters running the likes of ChatGPT and that’s given it a new seat at the top table of big tech.

It’s maybe worth noting that market analysts have been warning about Nvidia being overvalued for some time now, but they might reconsidering that right now as the company has pushed past the price it reached back in the heady days of late 2021, when its share price topped out at a shade under $330.

AI isn’t going away, and the fact it’s now trading for $412 is still pretty remarkable. But there have been noises about an AI tech bubble that could burst at some point sending share prices crumbling. That and the fact Nvidia made less than a tenth of the revenue that Alphabet did last year does maybe suggest that it is maybe a touch overvalued.

As an aside, Nvidia’s third largest shareholder, and member of the board, Tench Coxe has sold 100,000 shares since the biggest price rise last week. He’s cashing in to the tune of around $38 million, though given that he was said to have around 4.3 million shares in the company, as of this time last year, it’s not like he’s cashing out before things get rough.

3rd largest shareholder in $NVDA and board member since 1993 Tench Coxe selling shares today👇 pic.twitter.com/HiVwQYWqTGMay 30, 2023

Just a bit of extra pocket money then, I guess.

The real cautionary tale in this talk of the $1 trillion club is Meta. Facebook’s owner joined the club in 2021, but has since had its membership revoked and is listed with a market cap of just $682 billion today. In short, there is no guarantee that Nvidia is going to stay there, especially as the recent surge is all based on it supporting an area of business that is still very much in the formative stages, and things can change real quick.

If someone suddenly figures out a better way to power AI instead of monstrously powerful graphics chips—maybe Intel’s distributed local processing takes hold, for example—then that could have a big impact on the green team’s bottom line.

Basically, what I’m saying is don’t forget us PC gamers in all this AI talk, Jen-Hsun. Because we’ll always need better GPUs, whatever happens in the burgeoning AI realm.