A new report by Niko Partners and AppMagic analyses the mobile gaming market in the Asia and MENA regions.

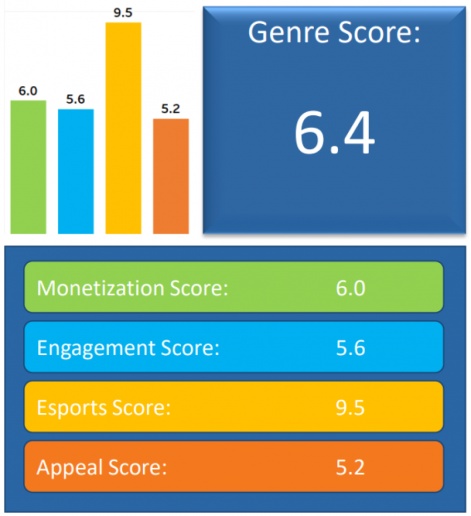

The report breaks down the performance of five key genres – RPG, strategy, MOBA, puzzle, and battle royale – in several important metrics: monetisation, engagement (including aspects such as average playtime per week and length of time before churning), appeal (including gender disparity among players and financial and age brackets), and esports.

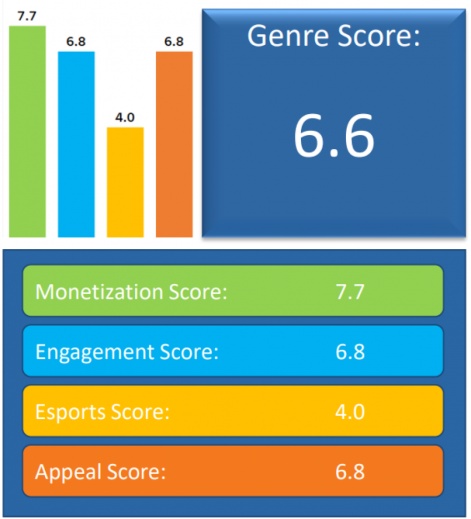

RPG proved to be the largest genre by revenue in Asia and MENA in 2022, with a 50% higher combined spend than the strategy, MOBA, puzzle, and battle royale genres combined, according to. The success of the genre in East Asian countries in particular led to it having the having the highest revenue per download of all genres.

The genre also came first in terms of engagement out of the five genres analysed, however it falls short in terms of esports due to a lack of competitive elements. Notably, however, the genre has a wider appeal than others with a male skew of 61%, compared to other genres with a male skew of over 70%. The genre proved to be a particular success in South Korea, where it accounted for 75% of all mobile gaming revenue, and players of the genre had the highest average income of all analysed genres.

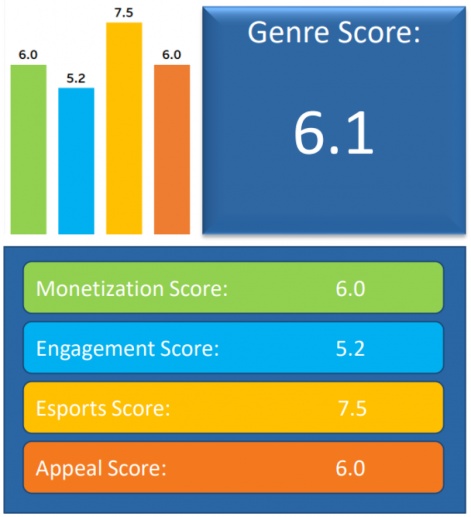

Strategy was the second largest genre in terms of revenue and the third largest by downloads, however it came in fourth place in terms of revenue per download, and the lowest of all genres in terms of engagement score, with players on average playing strategy games for 5.1 hours a week. Despite this, the genre had the second highest appeal score, with players being unlikely to be dissatisfied and most likely to try new games within the genre.

Interestingly, the strategy genre’s strong performance in Asia and MENA in 2022 came as it saw declines in the west. The report notes that “innovation within the strategy genre, which involves combining traditional gameplay with new sub genres, has helped the genre remain engaging for players

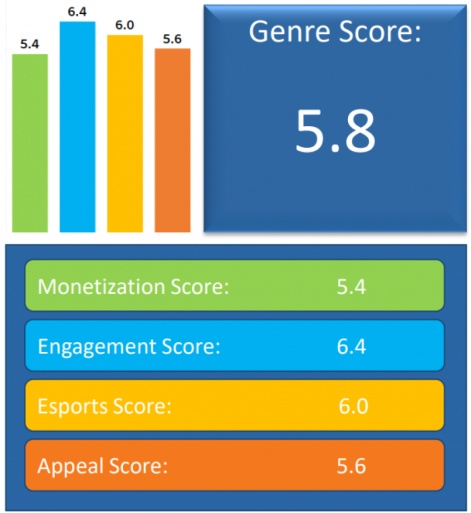

MOBA had the highest engagement score of all genres, with gamers throughout the region playing MOBA titles for an average of six hours a week, as well as sticking with the titles for longer. The genre also scored highly in terms of total spending and revenue per download, but players had the lowest average income and spent less on the genre on average.

Crucially, MOBA games have the youngest average player base, and a more equal gender split than strategy and battle royale titles. However, the report notes that the genre MOBA is “a tough genre to crack due to the dominance of a few titles in the region. In

addition, existing MOBA gamers are extremely loyal to their preferred game, being least likely to play another game within the MOBA genre.”

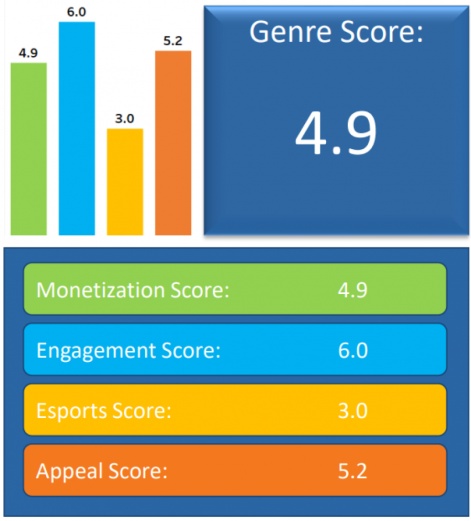

Puzzle games had more downloads than any other genre in the study, driven by a high number of total downloads and downloads per gamer. This was enough to offset the fact that, at 3.9 hours per week, players spent less time engaging in puzzle titles than any other genre in the study.

Puzzle gamers had the lowest percentage of in-game spenders, however they had the second highest average income behind RPG. In terms of demographics, the genre had the highest average aged players, and the second most even gender split. The genre’s fans were also the least engaged with esports, being less likely to either compete in tournaments or steam esports events online.

Innovation within the puzzle genre saw several subgenres, such as merge games, perform well throughout 2022. The genre’s fans throughout Asia and MENA were the most likely to value localisation, highlighting the broad appeal of the genre to new players who may be concerned that gaming won’t effectively reflect their own culture.

Battle royale games have seen significant growth since 2018, and came first in terms of the number of players who have purchased in-game items in the last year, with 55.1% of the genre’s audience doing so. Despite this, the genre had the lowest total revenue of those included in the study.

The genre saw high engagement, with players spending a high number of hours playing battle royale games, and doing so over a longer of period of time before churning.

Battle royale proved to be the top performer in terms of esports engagement, with players watching an average of 2.5 hours of content per week. 60.2% of battle royale players consider themselves esports fans, and the genre’s fans are more likely to aspire to compete in either professional or amateur tournaments. Despite this, battle royale has a narrow appeal, with a notable skew towards male players and players reportedly more likely to be dissatisfied with the game they’re playing.

The report also notes that the market for shooter battle royales has become oversaturated, however opportunities exist for both non-shooter battle royale games and casual competitive titles utilising battle royale mechanics.

Success in markets

Both Asia and the MENA region are veritable gaming powerhouses, but whereas Asia has long been one of the world’s biggest gaming markets, the MENA region is on the rise, with mobile at the forefront. The platform’s accessibility and the increase in mobile penetration has led to an explosion of mobile gaming and Saudi Arabia, the region’s biggest gaming market, has made the platform central to its gaming and esports strategy, with key acquisitions of mobile powerhouse Scopely and significant investments in game makers with robust mobile presences such as Embracer Group and Nintendo.

Asia, the world’s biggest continent, has a varied market and, while some regions such as Japan have been slow to adapt to mobile gaming, others such as Southeast Asia and China have historically shown a strong preference for gaming on their phones, with China being the world’s largest mobile gaming market and home to key players such as NetEase, Tencent, and MiHoYo.

We listed several of the companies mentioned in this article as some of the top 50 mobile game makers of 2022. We’ll be unveiling our list for 2023 soon.